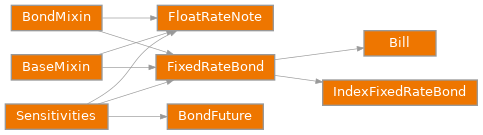

Securities#

Securities are generally one-leg instruments which have

been packaged to provide specific methods relevant to their

nature. For example bonds have yield-to-maturity and accrued interest

for example.

Create a fixed rate bond security. |

|

Create a floating rate note (FRN) security. |

|

|

Create a discount security. |

Create an indexed fixed rate bond security. |

|

|

Create a bond future derivative. |

Fixed Rate Bond#

Fixed rate bonds can be constructed and priced with traditional metrics. The following example is taken from the UK DMO’s documentation.

In [1]: bond = FixedRateBond(

...: effective=dt(1995, 1, 1),

...: termination=dt(2015, 12, 7),

...: frequency="S",

...: convention="ActActICMA",

...: fixed_rate=8.0,

...: ex_div=7,

...: settle=1,

...: calendar="ldn",

...: )

...:

The price in a dirty and clean sense related by the accrued is visible

below for a ytm (yield-to-maturity) of 4.445%.

In [2]: bond.price(

...: ytm=4.445,

...: settlement=dt(1999, 5, 27),

...: dirty=True

...: )

...:

Out[2]: 141.07013154004537

In [3]: bond.ex_div(dt(1999, 5, 27))

Out[3]: True

In [4]: bond.accrued(dt(1999, 5, 27))

Out[4]: -0.24175824175824176

In [5]: bond.price(

...: ytm=4.445,

...: settlement=dt(1999, 5, 27),

...: dirty=False

...: )

...:

Out[5]: 141.31188978180361

Bonds can also be priced by a discount Curve. Since the

bond has settlement timeframe of 1 business day this will be one business day

after the initial node date of the curve.

In [6]: bond_curve = Curve({dt(1999, 5, 26): 1.0, dt(2015, 12, 7): 0.483481})

In [7]: bond.rate(bond_curve, metric="dirty_price")

Out[7]: 141.0701685565273

In [8]: bond.rate(bond_curve, metric="ytm")

Out[8]: 4.444997474959312