API Reference#

Indices and tables#

Notation#

Defaults#

Classes#

|

The defaults object used by initialising objects. |

|

Class to lazy load fixing data from CSV files. |

|

Enumerable type to handle setting default values. |

Calendars#

Functions#

|

Add a tenor to a given date under specific modification rules and holiday calendar. |

|

Create a calendar with specific business and holiday days defined. |

|

Calculate the day count fraction of a period. |

|

Returns a calendar object either from an available set or a user defined input. |

Scheduling#

Classes#

|

Generate a schedule of dates according to a regular pattern and calendar inference. |

Highlighted private functions#

Tests whether the given the parameters define a regular leg schedule without stubs. |

|

Attempts to infer either a front or back stub in an unspecified schedule. |

Piecewise Polynomial Splines#

Functions#

|

|

|

|

|

Evaluate a single x-axis data point, or a derivative value, on a Spline. |

Classes#

|

Piecewise polynomial spline composed of float values on the x and y axes. |

|

Piecewise polynomial spline composed of float values on the x-axis and Dual values on the y-axis. |

|

Piecewise polynomial spline composed of float values on the x-axis and Dual2 values on the y-axis. |

Dual (for AD)#

Functions#

|

Calculate the exponential value of a regular int or float or a dual number. |

Return the inverse cumulative standard normal distribution for given value. |

|

|

Calculate the logarithm of a regular int or float or a dual number. |

Return the cumulative standard normal distribution for given value. |

|

Return the standard normal probability density function. |

|

|

|

|

Return derivatives of a dual number. |

|

Changes the order of a |

|

Convert a float, |

Classes#

|

Dual number data type to perform first derivative automatic differentiation. |

|

Dual number data type to perform second derivative automatic differentiation. |

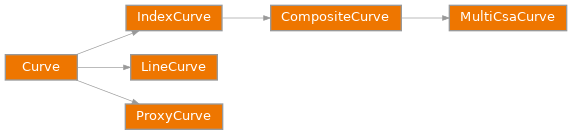

Curves#

Functions#

|

Return the geometric, 1 calendar day, average rate for the rate in a period. |

|

Return the interval index of a value from an ordered input list on the left side. |

|

Perform local interpolation between two data points. |

Classes#

|

A dynamic composition of a sequence of other curves. |

|

Curve based on DF parametrisation at given node dates with interpolation. |

|

A subclass of |

|

Curve based on value parametrisation at given node dates with interpolation. |

|

A dynamic composition of a sequence of other curves. |

|

A subclass of |

Class Inheritance Diagram#

FX#

Functions#

|

Return a forward FX rate based on interest rate parity. |

Classes#

|

Class for storing and calculating FX forward rates. |

|

Object to store and calculate FX rates for a consistent settlement date. |

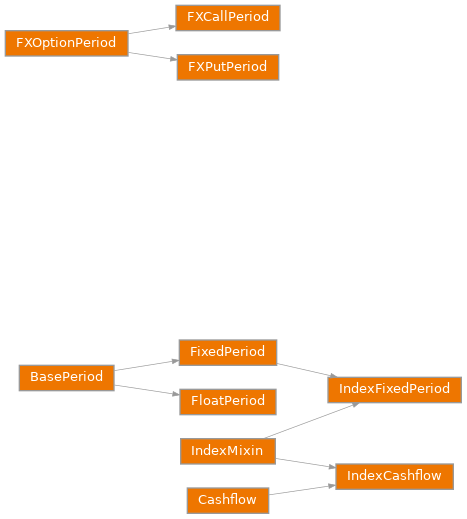

Periods#

Link to the Periods section in the user guide.

Classes#

|

Abstract base class with common parameters for all |

|

Create a single cashflow amount on a payment date (effectively a CustomPeriod). |

|

Create an FXCallPeriod. |

|

Create an FX Volatility Smile at a given expiry indexed by delta percent. |

|

Abstract base class for constructing volatility components of FXOptions. |

|

Create an FXPutPeriod. |

|

Create a period defined with a fixed rate. |

|

Create a period defined with a floating rate index. |

|

Create a cashflow defined with a real rate adjusted by an index. |

|

Create a period defined with a real rate adjusted by an index. |

Abstract base class to include methods and properties related to indexed Periods. |

Class Inheritance Diagram#

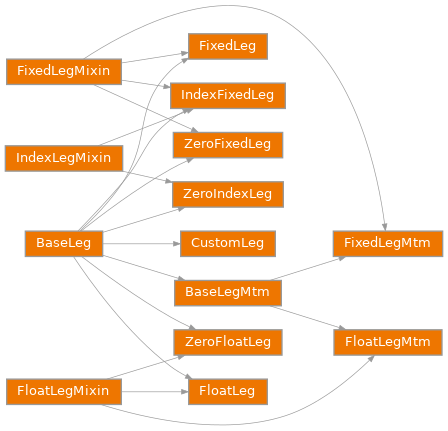

Legs#

Link to the Legs section in the user guide.

Classes#

|

Abstract base class with common parameters for all |

|

Abstract base class with common parameters for all |

|

Create a leg contained of user specified |

|

Create a fixed leg composed of |

Add the functionality to add and retrieve |

|

|

Create a leg of |

|

Create a floating leg composed of |

Add the functionality to add and retrieve |

|

|

Create a leg of |

|

Create a leg of |

|

Create a zero coupon fixed leg composed of a single |

|

Create a zero coupon floating leg composed of |

|

Create a zero coupon index leg composed of a single |

Class Inheritance Diagram#

Instruments#

Classes#

|

Abstract base class with common parameters for many |

|

Create a discount security. |

|

Create a bond future derivative. |

|

Create a forward rate agreement composing single period |

|

Create an FX Call option. |

|

Create an FXCallPeriod. |

|

Create an FX Volatility Smile at a given expiry indexed by delta percent. |

|

Create a simple exchange of two currencies. |

|

Create an FX Option. |

|

|

|

Create an FX Put option. |

|

Create an FXPutPeriod. |

|

Create an FX Risk Reversal option strategy. |

|

Create an FX Straddle option strategy. |

|

Create an FX Strangle option strategy. |

|

Create an FX swap simulated via a Fixed-Fixed |

|

Create a fixed rate bond security. |

|

Create a floating rate note (FRN) security. |

|

A butterfly instrument which is, mechanically, the spread of two spread instruments. |

|

Create an indexed interest rate swap (IIRS) composing an |

|

Create an interest rate swap composing a |

|

Create an indexed fixed rate bond security. |

|

Create a collection of Instruments to group metrics |

|

Create a single currency basis swap composing two |

|

Create a short term interest rate (STIR) future. |

Base class to add risk sensitivity calculations to an object with an |

|

|

A spread instrument defined as the difference in rate between two Instruments. |

|

A null Instrument which can be used within a |

|

A null Instrument which can be used within a |

|

Create a cross-currency swap (XCS) composing relevant fixed or floating Legs. |

|

Create a zero coupon index swap (ZCIS) composing an |

|

Create a zero coupon swap (ZCS) composing a |

Class Inheritance Diagram#

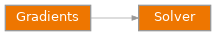

Solver#

Functions#

|

Concatenate pandas objects along a particular axis. |

|

Calculate the logarithm of a regular int or float or a dual number. |

|

|

|

Return derivatives of a dual number. |

|

Use the Newton algorithm to determine to root of a function searching many variables. |

|

Use the Newton-Raphson algorithm to determine the root of a function searching one variable. |

|

Return the current time in seconds since the Epoch. |

|

Generate a random UUID. |

Classes#

A catalogue of all the gradients used in optimisation routines and risk sensitivties. |

|

|

A numerical solver to determine node values on multiple curves simultaneously. |

Class Inheritance Diagram#

Cookbook#

- Replicating a SOFR Curve & Swap from Bloomberg’s SWPM

- Solving Curves with a Dependency Chain

- How to Handle Turns in Rateslib

- Pricing IBOR Interpolated Stub Periods

- Building a Risk Framework Including STIR Convexity Adjustments

- Exploring Bond Basis and Bond Futures DV01

- Bond Future CTD Multi-Scenario Analysis

- Working with Fixings

- Comparing Curve Building and Instrument Pricing with QuantLib